December 7

The Rise of the Variable Price tariff in Europe - variable prices compared

Since 2009 the Household Energy Price Index (HEPI), has been tracking European retail energy prices, initially for the EU15 and later the EU28 (now 27) and then some. It will not come as any surprise that never, in all the years of HEPI, have prices been as high or volatile as during the present energy crisis. However, what is also apparent (in most markets) to anyone who has recently been looking for a better deal on their energy, looking to protect themselves from the massive price increases, or simply coming to the end of a fixed-term contract, is how few options there are and how expensive the fixed price options are.

Until the crisis the most popular tariffs, in active markets at least, were fixed prices. What's more, it was quite common for such tariffs to be cheaper (albeit slightly) than variable tariffs due to the tie-in and hedging advantage it brought to suppliers. The situation is now very different. Many or most suppliers (in some markets all) no longer offer fixed prices, and as seems to be the way of the world these days, polarization has also hit the energy industry in the form of fixed versus variable price levels. In some markets fixed-price offers are currently around double the price of variable price offers, and although the difference is smaller in other markets, the trend is increasing divergence.

It would be wrong to claim, as some do, that no customer wants a fixed price contract if it means paying a lot more. Indeed, with variable prices travelling ever upwards, some customers are deciding 'better the devil you know' and choosing to pay a premium in order protect themselves from the scary unknown of future energy prices. Nevertheless, a large proportion of customers have moved onto variable prices in recent months, either because of the high price or low availability of fixed prices (in some markets they are simply no longer available), or because of the apparent safety offered by e.g. capped or regulated prices. It should be noted, by the way, that in some other markets, such as Greece, variable prices have always been by far the most common.

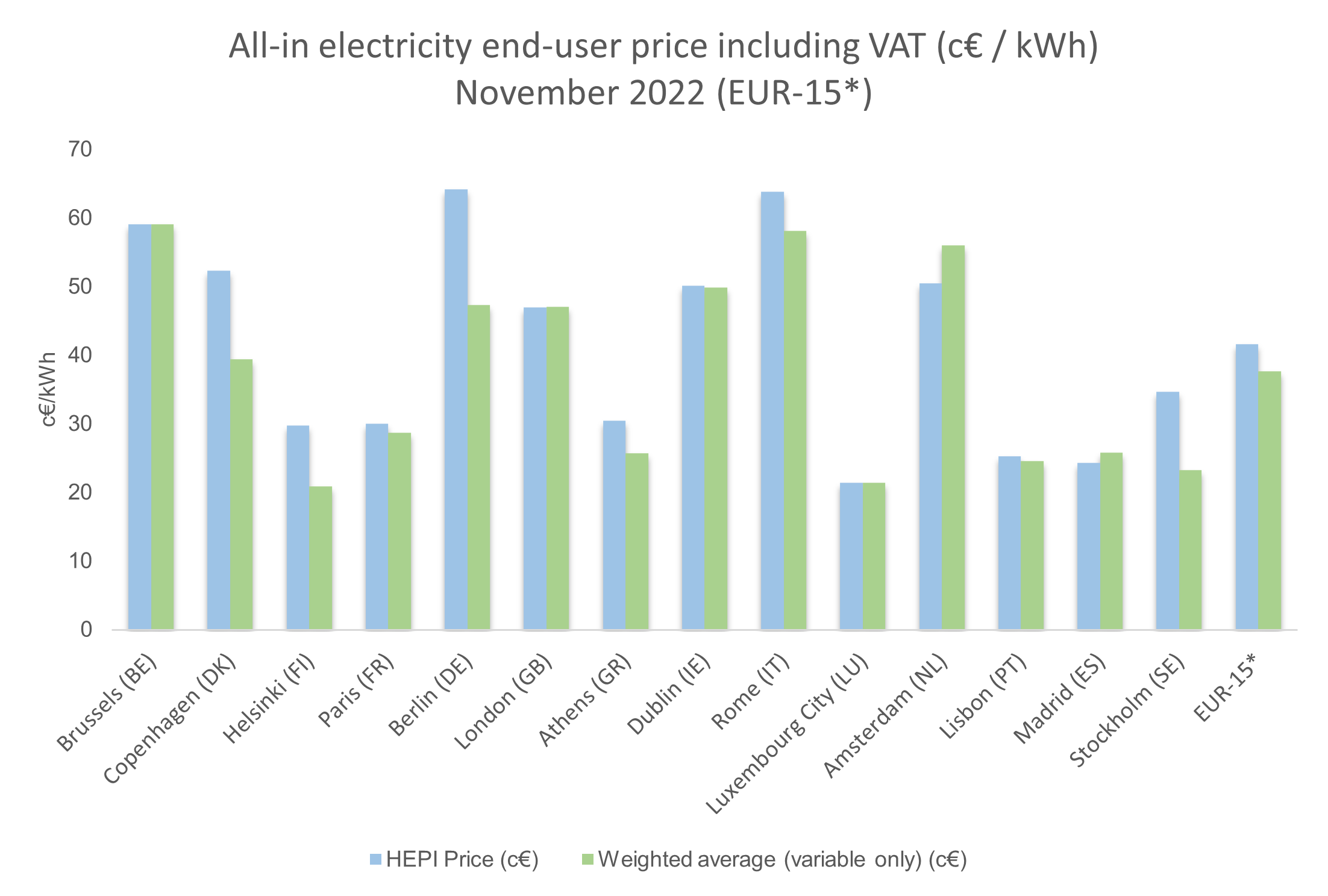

This blog will not go into greater detail into the popularity or comparison of fixed and variable tariffs - a later blog will focus more on that issue - but we thought it important, given the current popularity of variable tariffs, and the divergence between fixed and variable tariffs, to compare variable prices across Europe (just the EUR-15 in this blog) for November 2022, using what is otherwise the HEPI price collection approach. The following figure shows the weighted average of offer prices, per EUR-15* capital city, for variable price tariffs only.

*Austria is not included on this occasion due to the lack of offers in variable contracts

But while variable prices differ from fixed prices, do variable prices differ from the HEPI averages for the same EUR-15 markets? Well the answer is yes, but perhaps less than you might think, since HEPI represents a mix of tariffs, therefore somewhat neutralising extreme differences. The following figure illustrates the HEPI prices versus the weighted variable prices for each market. Interestingly, the EUR-15 HEPI price average is very similar to the average for variable tariffs, although it is, as expected, a little higher.

*Austria is not included on this occasion due to the lack of offers in variable contracts

But what about the future. Will variable prices remain the better option? The answer is not yet clear. If the crisis were to ease, and wholesale markets began to fall, we would expect fixed prices to once again come in line, eventually at least. For now, however, it would be a brave supplier who would bet on the crisis ending any time soon.

For more information on European energy prices, see here.

Authors:

Philip Lewis

Iliana Papamarkou